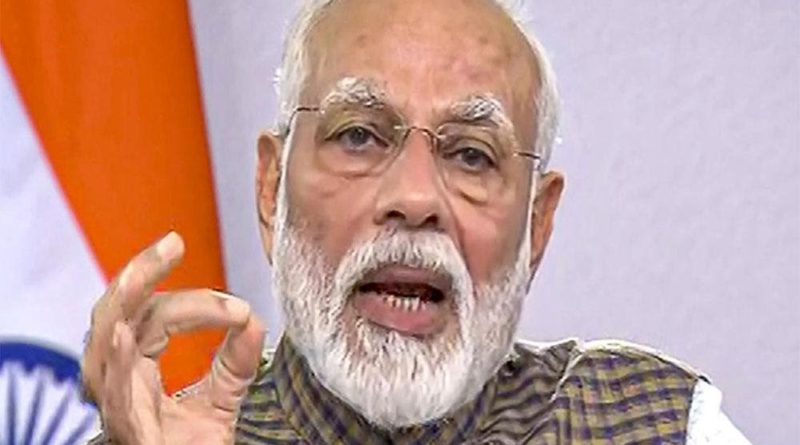

PM Modi says RBI’s decisions will protect Indian economy from COVID-19

Prime Minister Narendra Modi on Friday ,March 27 welcomed the Reserve Bank of India’s ‘’giant steps to safeguard the economy from the impact of the coronavirus’ ’The RBI cut the benchmark interest rate by 75 basis points to 4.4 per cent to deal with the hardship caused due to the outbreak of COVID-19.”The announcements will improve liquidity, reduce cost of funds, help middle class and businesses,” PM Modi wrote on Twitter.AN estimated Rs 3.74 lakh crore liquidity will be infused into the financial system to tackle COVID-19 impacting Indian economy. At press conference in Mumbai, Reserve Bank of India Governor Shaktikanta Das has gone on record saying that Financial markets are under stress and require steps by the central bank for market stability and revival of economic growth. As part of liquidity infusion measures the Reserve Bank of India will undertake repo operation of up to Rs 1 lakh crore to infuse liquidity into the market.Further, he announced reduction in cash reserve ratio (CRR) of all banks by 100 bps to 3 per cent from 4 per cent, with effect from March 28 for one year. This is expected to release Rs 1.37 lakh crore liquidity in the market, he said. CRR is the percentage of deposits that banks have to mandatorily keep with the central bank adding the public, he added urging people not to worry about the Indian banking system as it is sound.