IT Is A PLEASE All Budget to Help Growth

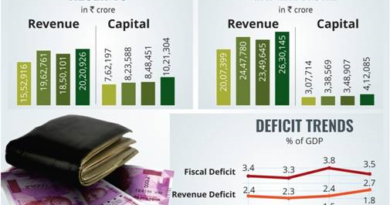

AS in previous years, presentation of India’s federal budget in The Lok Sabha on February 1,has evoked mixed reaction from the opposition parties and the political parties comprising the ruling NDA.As people becoming more and more aspirational and the condition of the farming community , especially the small and marginal ones among them, is worsening day by day it is undoubtedly more than an uphill task to frame a budget as per their expectations. With the opposition determined to seize power from the incumbent government, major industry bodies have hailed the Union Interim Budget for 2019-20 and called it a people’s budget which will help the economy grow economically. As Confederation of Indian Industry’s Director General Chandrajit Banerjee reacts saying “A lot has been done for farmers and middle-class people.” There is no denying that the farm sector, the growing middle class and working people contribute the maximum to India’s GDP growth story. The middle class alone will be 44 per cent by 2022 and remain big consumers along with the farmers and the working people. They will substantially help create consumption of almost products that the economy needs. Not only e-commerce will flourish but also mom and pop stores and street vendors will benefit significantly. The Budget will benefit at least 15 crore people, including 12 crore farmers and 3 crore salaried class. The Interim Budget provides support to the 95 per cent of workers in the unorganised sector who were left to fend for themselves. The government has proposed to launch a mega pension scheme called Pradhan Mantri Shram Yogi Maandhan for the unorganised sector workers with monthly income up to INR 15,000 per month. Presently, the labour in the organised sector which actually may not be less than 5 per cent of the total workforce is a sheltered lot but the rest of 95 per cent were left to fend for them self as said FICCI President Sandip Somany. The direct income transfer to the farmers is an excellent step and would benefit the 12 crore small and marginal farmers by giving them INR 6,000 per year to buy seeds and fertilisers or for the other uses. The amount should be enhanced later both in the interest of the farming community and economy. To begin with, the amount is okay. But it must not remain stagnant. The government’s proposal to extend interest subvention to the fisheries and animal husbandry is a positive step as also the 3 per cent subvention which is proposed to be given on timely submission of loan is a positive step. The proposal to increase tax exemption limit up to Rs 5 lakh is a welcome step. Though the budget will benefit middle class it will go a long way in reducing urban and rural divide. However, a lot more requires to be done for the corporate and medium enterprises for the creation of jobs as well also national assets. More and more local MSME manufacturers and sellers can cater to this increased demand from rural, tier 2/3 towns and the e-commerce outlets will be happy to support thousands of such sellers to access the consumers cost effectively and efficiently. Opposition has rightly expressed concern over missing the fiscal deficit for the second year in succession. It can be attributed to higher allocation of funds to agriculture schemes. Higher consumption by the rural masses and middle class people will in the long run result in collection of larger amount of GST which will be shared by state and central governments. They are all in a win- win situation. Government has rightly identified several focus areas during the financial year 2019-2020 —job creation, physical and social infructure projects, a pollution free nation and clean rivers for ensuring safe drinking water, self sufficiency in foodgrains, high farm production, food processing, preservation ,packaging and maintenance of cold chains in the interest of consumers and also farming community. With coming up of high skilled and professional institutions all over India, promotion of job-oriented enterprises should be accorded priority. Central and state governments with public and private sectors should work in unison to create employment generation programs and national assets. With the setting up a separate department at the centre for the promotion of fisheries and Rashtriya Kamadhenu Aayog to upscale sustainable genetic upgradation of cow resources and to enhance production and productivity of cows, it is hoped multiple job opportunities will be created. It is indeed inclusive and people friendly budget aims at benefit every section of the society including the unorganised workers who are the backbone of India. GST has already been brought down most taxes on goods from 31% tax to the 18%, 12% and the 5% bracket. Inflation remains under control despite seasonal vegetables and fruits impacted by vergies of nature. Never in the history of India during the five year tenure of a Government we have witnessed tax reduction and a Middle Class relief of this magnitude as a trained Chartered Account (CA) turned politico Piyush Goyal, who presented the budget in the budget in Parliament, claimed. In surging India, expected to the world’s fifth largest economy people earning up to Rs 6.5 lakh don’t have to pay any tax if they invest well, claims Finance Minister Piyush Goyal. And with other exemptions for home loans, college loans, etc, even those earning up to Rs 8.5 lakh, maybe even more, will not have to pay any tax at all. (Courtesy: musingsofaseniorjournalist.wordpress.com)