Relief for Income-Tax payers: Dividend Distribution Tax for corporate sector abolished

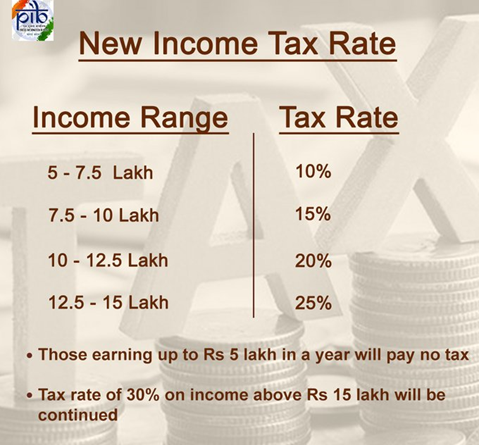

IN the Union Budget for 2020-21, presented on February 01 in the Lok Sabha ,Finance Minister Nirmala Sitharaman has proposed 15% tax for income between 7.5 lakh to 10 lakh; 20% tax for income between 10 lakh to 12.5 lakh; 25% tax for income between 12.5 lakh to 15 lakh; 30% tax for income above 15 lakh and no income tax for those with taxable income below Rs 5 lakh. Sitharaman says Rs 40,000 crore per annum will be revenue foregone from new income tax rates. Dividend distribution tax has been abolished. Companies will no longer be required to pay DDT. A total of Rs 25,000 crore is revenue foregone due to DDT abolition, says FM. This will make India an attractive investment destination, she added. TTe new Income tax rates are as follow: No tax up to Rs 5 lakh.# 10% tax for income between Rs 5 lakh to Rs 7.5 lakh. FM Nirmala Sitharaman says that there will be loss of substantial revenue in the short term due to the corporate tax rate cut. “New simplified income tax regime soon,” will be in place soon, she adds.Steps being taken to professionalize cooperative banks. Deposit insurance cover being raised five-fold to Rs 5 lakh per account from Rs 1 lakh per account at present. This measure is important in the backdrop of recent default by cooperative lender PMC Bank. Steps being taken to professionalize cooperative banks. A taxpayer charter will be institutionalized in the statute to build trust, Sitharaman said.