RTGS functions nonstop round the clock

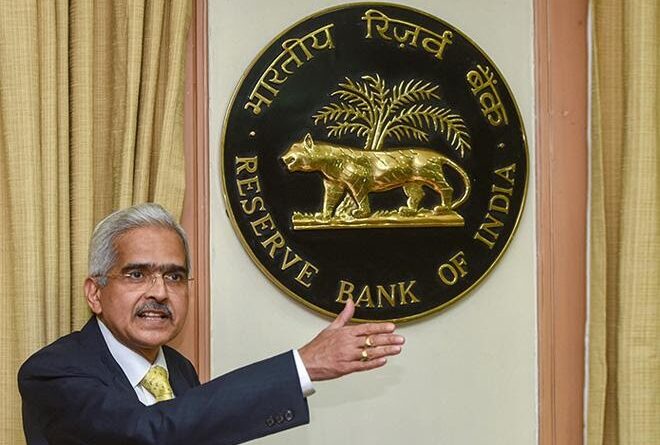

RESERVE Bank of India has made RTGS transfer of money round the clock operational. Instantaneous transfer of money and securities under the Real-Time Gross Settlement (RTGS) is the continuous process of settling payments on an individual order basis without netting debits with credits across the books of a central bank.RTGS and NEFT systems have also become cheaper from Monday, December 14 after the Reserve Bank of India decided not to impose any charges on such transactions. After announcing its decision to waive all charges on fund transfer through RTGS and NEFT systems from July 1, the Reserve Bank of India (RBI) had also asked banks to pass on the benefits to customers from the same day. The announcement to this effect was made by RBI Governor Shaktikanta Das on Twitter. He said it has been decided to make RTGS available round the clock on all days of the year from last night. RBI Governor said, India has become one of the few countries in the world to operate its RTGS system round the clock throughout the year. The move is aimed at giving a push to digital payments in the country. Earlier, RTGS transaction facility was available for customers from 7 am to 6 pm on all working days of a week, except the second and fourth Saturdays. The RTGS system is meant for high-value transactions, on a real-time basis. The minimum amount that can be remitted through RTGS is 2 lakh rupees and there is no maximum limit. The beneficiary bank receives instructions to transfer the funds immediately after the transaction is carried out, and the transfer is instantaneous. On the other hand, NEFT handles fund transfers up to 2 lakh rupees and such transactions are usually executed in a couple of hours. Meanwhile, RBI has also decided to increase the limit for contactless card transactions to 5,000 rupees from 2,000 at Point-of-Sale terminals from January 1 in view of the COVID-19 pandemic and feedback from stakeholders. Image courtesy: ORF