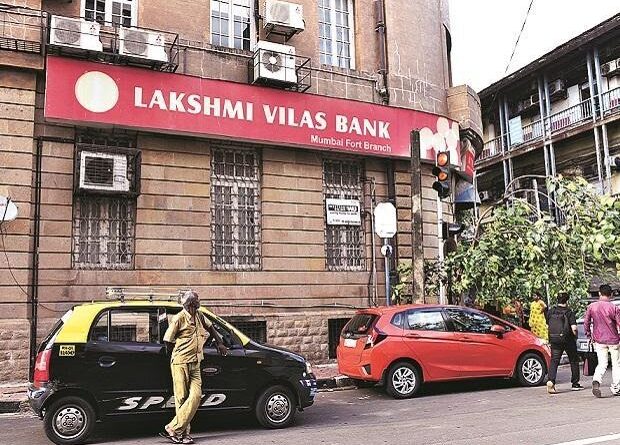

LVB put under moratorium, proposed to be merged with DSB

CHENNAI headquartered Lakshmi Vilas Bank (LVB) established in 1926 has been brought under moratorium from 1800 hrs IST on November 17 for a month by the Reserve Bank of India restricting withdrawals beyond Rs 25, 000 per borrower during this period. The account holders can, however, withdraw above this limit for unexpected expenses, including medical treatment, education etc, RBI has assured the depositors of LVB that their interests will be protected and asked them not to panic. The Reserve Bank of India had submitted an application to the Centre under Section 45 of the Banking Regulation Act 1949, seeking to impose moratorium on the LVB citing “The rapidly deteriorating financial position of Lakshmi Vilas Bank relating to liquidity, capital and other critical parameters, and the absence of any credible plan for infusion of capital. RBI has also announced a draft scheme for the amalgamation of LVB with DBS Bank India Ltd. (BDIL), a subsidiary of DBS Group Holdings Limited and added, “DBIL has a healthy balance sheet, with strong capital support.” RBI also said that it has superseded the Board of Directors of LVB for a period of 30 days owing to serious deterioration in the financial position of the bank and that this has been done to protect the depositors’ interest. The RBI in a public domain has sought suggestions or objections, in any, from the depositors and creditors of LVB and DBIL on the proposed amalgamation. The suggestions and objections will be received by Reserve Bank up to 1700 IST on November 20, 2020.As BUSINESS STANDARD says’’ considering that the RBI had already appointed a three-member committee of directors with discretionary powers of MD and CEO, the order placing LVB under moratorium was not surprising has been in rough weather for a few years. In September, shareholders voted against seven board members — including interim MD and CEO S Sundar — at the annual general meeting. Further, the bank has been struggling to raise capital for the last few years’’.